On Tuesday, March 4, the Cato Institute hosted a panel discussion on the proposed IRS rulemaking for 501(c)(4) organizations. As CCP noted in our third set of comments to the IRS, this rulemaking redefines “political activity” so broadly and is so unworkable as to severely restrict the speech rights of all 501(c)(4) groups, regardless of political orientation or organizational mission. Moderated by Trevor Burrus of the Cato Institute, the event featured the perspectives of Cleta Mitchell, an election lawyer; Gabriel Rottman, Legislative Counsel and Policy Advisor for the American Civil Liberties Union; Laurence Gold, a political and advocacy lawyer specializing in labor law; and CCP’s own President David Keating. Despite coming from different political and ideological backgrounds, all four expert panelists agreed that the new rules proposed by the IRS should be withdrawn and reconsidered.

Mitchell shared her experiences representing conservative groups that were targeted by the IRS with delayed applications and inappropriate questioning starting in 2009. Mitchell’s story provides important context for the proposed rulemaking and serves as a crucial reminder that real people are affected by the minutiae of campaign finance and administrative law. If you weren’t able to see the event and want to learn more about how it all started, CCP’s timeline of events in the IRS targeting scandal is a very useful resource.

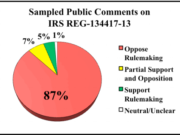

Rottman explained why groups from across the political spectrum are united in opposition to the proposed rule by detailing its many flaws, such as conflating partisan political activity with nonpartisan issue advocacy and instituting overbroad ‘blackout’ periods in which (c)(4) groups would not even be allowed to say the name of a candidate or political party without jeopardizing their tax-exempt status. Here at CCP, we’re always looking for allies in our fight for free speech in campaigns, but it isn’t usually as easy as it’s been with the IRS rulemaking, which has received over 143,000 comments from the public, most of which are deeply opposed. As Rottman and Gold both noted, the proposed rule is so bad that groups from virtually every political persuasion are standing up against it. Several panelists remarked that they had yet to find any substantive defense of the rule among the hundreds of thousands of public comments submitted.

Gold argued more generally that any one-size-fits-all approach to regulating political activity by different kinds of organizations is doomed to fail. In its rulemaking, the IRS solicited comments on whether its proposed rules for (c)(4) organizations should also be applied to (c)(5) labor unions or (c)(6) trade associations. Gold explained that the differences in the organizational structures and law governing charities, social welfare groups, labor unions, and trade associations make such uniform regulation impossible. Gold also agreed with Rottman’s criticisms of the rule as applied to (c)(4)’s. He called the rule “unprofessional” and expressed his belief that the IRS has the capacity to do much better.” We certainly agree.

Keating expanded on the idea that the IRS simply isn’t institutionally capable of making the sort of political determinations that both current law and the proposed rule demand of the beleaguered agency. He explained how the proposed rule ignores, or fails to incorporate, key concepts from landmark Supreme Court decisions in campaign finance and First Amendment cases. If citizens are going to be made to jump through hoops to exercise their free speech rights, the least the government can do is ensure that only expert agencies make and enforce the law. Dragging a revenue collection agency into the business of regulating political speech is bad government that will only make the IRS scandal more likely to recur in the future.

Events like the panel discussion at Cato make it painfully clear that Americans from across the political spectrum are opposed to the IRS rulemaking. With the public comment period now over, we’ll soon find out just exactly how much the IRS cares about what the public wants. CCP will be on guard to see what happens next. With a record number of comments and a bipartisan coalition of groups on our side, we won’t be alone.